Foreign Investors sell Rs 34,574 crore worth of equities in February, total outflow at Rs 1.12 lakh cr in 2025

ANI

01 Mar 2025, 13:40 GMT+10

Mumbai (Maharashtra) [India], March 1 (ANI): Foreign portfolio investors (FPIs) continued to pull out funds from the Indian stock market in February, selling equities worth Rs 34,574 crore, according to data from the National Securities Depository Limited (NSDL).

The trend of selling remained strong throughout the week from February 24 to February 28, during which FPIs offloaded equities worth Rs 10,905 crore.

However, on Friday, foreign investors turned net buyers, investing Rs 1,119 crore. Despite this, Indian stock markets witnessed a sharp decline on Friday, with both the Nifty and Sensex falling by over 1.8 per cent.

So far in 2025, foreign investors have sold a total of Rs 1,12,601 crore worth of equities, indicating a persistent outflow of funds.

The strengthening of the US dollar and concerns over India's economic outlook have dampened investor sentiment, leading to continued selling pressure in the markets.

The ongoing FPI outflows have impacted market stability, contributing to volatility in Indian equities.

In January the FPIs withdrew Rs 78,027 crore from the Indian stock market. Last year in December the net investment by FPIs in Indian equities stood positive, with a net investment of Rs 15,446 crore.

The year 2024 marked a positive ending, but the net buying value in Indian equities by FPIs drastically reduced, declining to Rs 427 crore.

The continuous selling spree by foreign investors has raised concerns among market participants. A combination of global uncertainties, rising US bond yields, and concerns over geopolitical tensions could be some of the key reasons behind this selling trend.

This persistent selling is largely attributed to the return of Donald Trump to the political stage in the United States, which has boosted investor confidence in the US economy.

Additionally, outflows from emerging markets, including India, have been rising as investors shift towards safer assets.

The country experienced a drastic drop in Foreign Portfolio Investment (FPI) inflows in 2024, with net investments falling by 99 per cent compared to the previous year. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Kenya Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Kenya Star.

More InformationAfrica

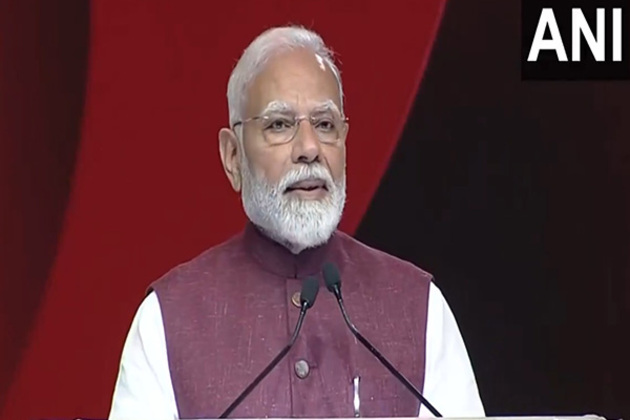

Section"No need to manufacture news, world wants to know India": PM Modi at NXT Conclave 2025

New Delhi [India], March 1 (ANI): Prime Minister Narendra Modi on Saturday highlighted India's capability to efficiently organize large-scale...

Xinhua Photo Daily | March 1, 2025

BEIJING, March 1 (Xinhua) -- A selection of the best press photos from Xinhua. A drone photo taken on Feb. 27, 2025 shows the construction...

SOUTH SUDAN-JUBA-PHYSICAL REHABILITATION CENTER

(250301) -- JUBA, March 1, 2025 (Xinhua) -- A nurse from the International Committee of the Red Cross (ICRC) South Sudan delegation...

Indian Coast Guard Ship 'Sachet' departs for Sudan with over 2 tons of life-saving medicines

New Delhi [India], March 1 (ANI): The Indian Coast Guard Ship Sachet departed for Sudan on Friday, carrying over two tons of life-saving...

US tariff hike on vehicle imports could impact Nigeria's auto market

ABUJA, NIGERIA — For longtime automotive importer David Tope, Nigeria's auto market has become increasingly difficult. He used to...

Paramilitary forces' attempt to form "parallel government" raises concern over deeper division in Sudan

A family is seen in a tent at a center for displaced people fleeing from conflict between the Sudanese Armed Forces and the paramilitary...

World

SectionArctic’s Svalbard Seed Vault to receive 14,000 new samples

COPENHAGEN, Denmark: A remote Arctic facility designed to preserve the world's agricultural diversity is set to receive a major new...

Marco Rubio extends wishes to Tibetans on Losar, expresses US commitment to protecting human rights of Tibetans

Washington, DC [US], March 1 (ANI): US Secretary of State Marco Rubio has extended wishes to Tibetans on Losar, also known as the Tibetan...

Foreign Investors sell Rs 34,574 crore worth of equities in February, total outflow at Rs 1.12 lakh cr in 2025

Mumbai (Maharashtra) [India], March 1 (ANI): Foreign portfolio investors (FPIs) continued to pull out funds from the Indian stock market...

Putin signs security guarantees for Belarus

Under a new law, Moscow would provide nuclear defense for Minsk in case of attack ...

Explainer: How did Trump, Zelensky engage in shouting match at White House?

U.S. President Donald Trump (2nd L) welcomes Ukrainian President Volodymyr Zelensky (2nd R) at the White House in Washington, D.C.,...

RBIs new governor stand of a flexible rupee led to 1.8pc depreciation against USD in 2025: UBI Report

New Delhi [India], March 1 (ANI): The policy shifts by the RBI in managing the Indian currency against the US Dollar have significantly...